Recommended Facts On Deciding On Gold Bullion Maple Leaf

Wiki Article

What Factors Should I Take Into Consideration When Purchasing Gold Coins/Bullion For Investment In Czech Republic

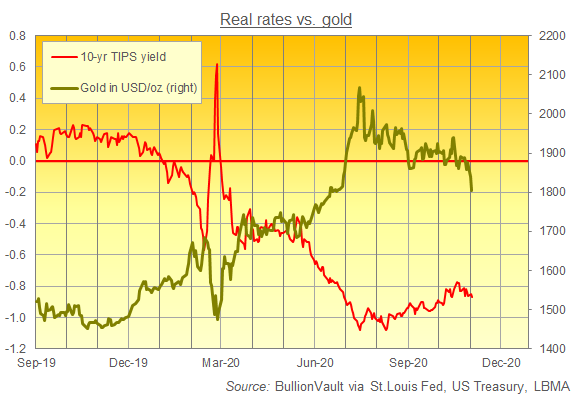

Tax Implications - Find out about the tax implications for purchasing and selling gold in the Czech Republic. There are different tax laws while investing in gold. This can affect your return. Market Conditions- Track the market's trends, which includes changes in the price of gold. This will allow you to make an informed decision about the best time to invest.

Authenticity: Make sure you check the certification of any gold coin or bullion before purchasing.

Find out the goal of your investment. Decide whether you are purchasing gold to secure your wealth over the long term, diversify your portfolio, or protect against fluctuations in the economy and inflation.

Consultation or Research- Consult experts and financial advisors as well as experts in precious metals to get guidance. Make smart investments by conducting exhaustive research about the gold market.

Gold can be a good investment. However, you should always approach all investments, including precious metals by conducting research and taking careful consideration. It is important to know your objectives in the financial realm and your the risk you are willing to take. Check out the most popular use this link for site recommendations including euro coins, gold and coin near me, 1 0z gold, sacagawea gold dollar, gold coin prices, 2000 gold dollar, gold ira, price for one ounce of gold, 1 ounce of silver, silver nickel and more.

How Do I Ensure That The Gold Coin I Purchase Is Of Good Quality? Or Bullion I Purchase In Czech Republic?

Verifying the authenticity and documentation of gold bullion as well as coins from the Czech Republic includes several steps.-

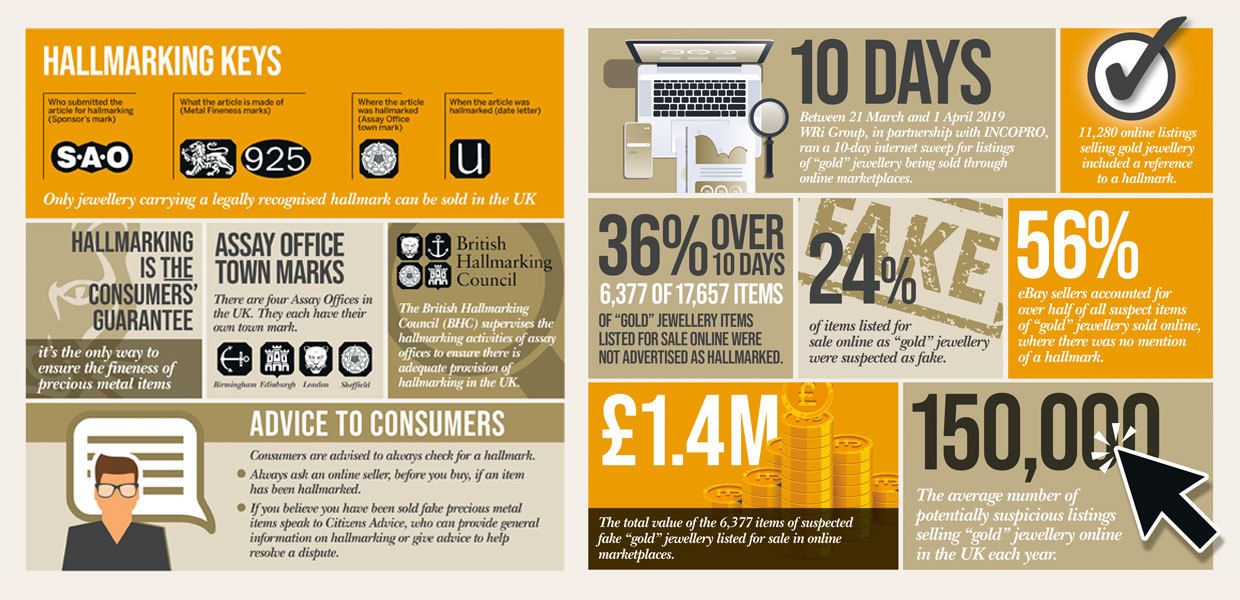

Hallmarks and certificationsSearch for the stamps or hallmarks accepted by the government on the gold item. These hallmarks show the purity, weight, and authenticity of the gold. They are typically provided by reputable assay offices or institutions of government. Purity Check- Test the purity of gold using markings that indicate the fineness or the karatage. For example, 24karat gold is considered pure and lower karatages show the different levels of alloying materials.

Reputable Sellers - Only buy gold from authorized or reputable dealers. They often supply the proper documentation like certificates of authentic and receipts that detail the requirements.

Documentation is required when purchasing gold, make sure you ask for certificates of authentication or assay certifications. These documents must include details on the gold's manufacturer and hallmark, weight and purity.

Independent Verification- Think about seeking an independent appraisal or verification by a third-party expert appraiser. They can assess the authenticity of the gold and give an objective assessment of its quality.

The process of confirming authenticity requires doing your due diligence. Making sure you are buying from reputable sellers and having the correct documents is crucial to ensure that you're buying authentic, high-quality bullion. See the top rated helpful site about buy Charles III coins for website advice including 24k gold bullion, chinese coins, gold coins for sale near me, best way to buy gold, gold coins for sale near me, 1 10 oz american gold eagle, gold dollar coin, cost of 1 oz of gold, sell gold and silver near me, best place to purchase gold and more.

What Is The Difference Between A Low Spread On Gold And A High Markup On Price Of Stocks?

Low mark-ups and spreads can be used to describe the costs of purchasing or selling gold relative to the market price. These terms refer to the amount of additional money you may pay (markup), or the difference in price between the selling and buying price (spread), beyond the price of gold that is market-value. Low Mark-up: This means the smallest additional cost or a premium over the gold market price that a dealer will charge. A low markup indicates that the price that you pay to buy gold is either close to the price, or is only slightly higher than the current market price.

Low Spread Price- The spread represents the price difference between the asking and buying prices for gold. A low price spread is a small gap between these prices which means there's less of a gap between the price you pay to purchase gold and the price at which you can sell it.

What Is The Price Difference? And Mark-Ups Differ Between Gold Dealers?

Negotiability. Some dealers are more flexible in negotiating markups and spreads. Geographical Location: Mark-ups or spreads can be affected by local factors, regional laws and taxes. Dealers located in areas that have high taxes or regulatory costs could pass the costs to their customers through greater markups.

Product Types and Availability Markups and spreads differ depending on the kind of item (coins/bars/collectibles) and availability. Due to their rarity rare and collectible items may command higher markups.

Market Conditions- If there is a large demand for a product, or a lack of or volatility in the market, dealers will increase their spreads as strategy to decrease the risk or protect against the losses.

Because of these reasons the gold buyers must conduct extensive research and compare prices with different dealers. It is also important to consider other factors than markups and margins such as the reliability of their service, customer service and reputation when selecting the right dealer. It's important to search for quotes and compare prices from various dealers. This will help you to get the best price for gold. Read the top buy Prague gold price blog for blog recommendations including 20 dollar coin, gold etf, best way to buy gold, gold eagle, silver nickel, 1 10 oz gold coin, silver eagle coins, 2000 sacagawea dollar, 1oz of gold, cost of 1 oz of gold and more.